Forgot about REITs: +0.36% in May, +15.3% LTM

- Martin Kollmorgen

- Jun 25, 2025

- 14 min read

“Ya’ll know me, still the same OG, but I been low key” – Dr. Dre. "Forgot about Dre". (1999)

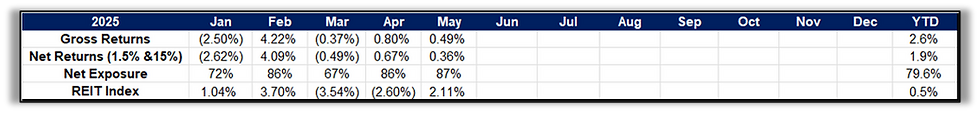

PERFORMANCE: Serenity Alternative Investments Fund I returned +0.36% net of fees in May vs the REIT index at +2.11%. Over the last twelve months (LTM), the fund has returned +15.3%.

FORGOT ABOUT REITS: Investors have seemingly thrown in the towel on the REIT market. Here are three things they may be missing.

STUDIO FULL OF TRACKS: Many REITs are finding attractive opportunities that investors should be aware of.

WALL FULL OF PLAQUES: REITs have prolifically steady cash flows…so is volatility a bad thing?

In 1999 Dr. Dre released an album titled “2001”, which went multi-platinum, hit number 1 on the billboard charts, and included the smash hit single “Forgot about Dre.”

The song is scathing rebuttal to critics who may have thought Dr Dre had lost a step, sold out, or gone soft.

In 2025, many institutions and investors in general have “forgot about REITs”.

And it may be precisely the wrong time.

Supply pressures in many property types are easing rapidly, the Federal Reserve is slowly lowering interest rates, and REITs are in a dominant capital position relative to private equity peers. Hyper cyclical AND high duration REITS are historically cheap, meaning if the economy either accelerates OR decelerates, there are significant deep value opportunities.

REITs have been low-key since 2021 as growth has slowed, competitive supply has been high, and interest rates have increased, but all three of these trends are in the process of reversing, potentially leading to a period of “REIT Nirvana” at some point within the next 3 years.

Remember, REITs are the OG’s of the commercial real estate industry. They own the largest, most irreplaceable CRE portfolios in the world, and have the best balance sheets in the industry. While many CRE funds continue to struggle and hand assets back to the bank, REITs are on the offensive, buying distressed assets and aggressively utilizing their cost of capital advantage.

The REIT bear market is over, but most investors still don’t know it. Have you forgot about REITs?

PERFORMANCE: +0.36% in May, +15.3% LTM

Serenity Alternative Investments Fund I returned +0.36% in May net of fees and expenses with +86% net exposure versus the MSCI US REIT Index which returned +2.11%. Year to date the fund has returned +1.9% versus 0.52% for the REIT index. On a last twelve-month (LTM) basis, the fund has returned +15.3%. Over the past 5 years Serenity Alternatives Fund I has returned +12.7% annually net of fees and expenses with a 1.02 Sharpe ratio, versus +9.4% for the REIT index.

The most profitable position in the fund in May was American Healthcare REIT (AHR), a long position which returned +8.24% for the month. AHR was the best performing position in the fund last month and continues to be one of the funds top holdings and best ideas. With significant exposure to Seniors Housing, AHR is well positioned to benefit from one of the most powerful demographically driven commercial real estate bull markets in history. We believe AHR represents a potent combination of potential NAV growth and relatively modest valuation within the Healthcare REIT sector, and we expect the company to produce top decile growth within REITs for the next 1-3 years. We remain long and consider AHR a core holding.

The worst performing position in the fund in May was Paramount Group (PGRE), a short position which returned +41% during the month. PGRE is a New York focused Office REIT which had underperformed peers badly over the last 5 years (-47% vs -28% for Office REITs from 4/30/2020 to 4/30/2025). Serenity’s CORE model has consistently ranked PGRE towards the bottom end of the REIT universe and their management team has consistently acted against shareholders best interests, while paying themselves handsomely. This made PGRE an excellent short candidate; a company with 0 or negative growth, an over-compensated management team, and a consistently low ranking in our CORE model. Unfortunately, as sometimes happens, PGRE’s management team decided in April to make a very shareholder friendly move, appointing a new CFO and announcing a “review of strategic options.” This sent the stock higher rapidly, as the breakup value of PGRE (like most Office REITs), is much higher than the company’s recent share price. While this type of event is extremely difficult to predict, Serenity will be more cautious, shorting potential take-out candidates in the future.

FORGOT ABOUT REITS: REITs remain out of favor...but for how long?

The largest REIT ETF by assets (the VNQ), saw its largest month of outflows since 2022 in March of this year. NAREIT’s REIT week conference, held in early June in New York City, was markedly subdued relative to years past, with much of the hallway chatter centered around the lack of interest in REITs from the broader investing community.

As a 15-year veteran of the industry, attending my 15th annual REIT week conference… it was noticeably quiet as I walked the halls and chatted with REIT colleagues early this month.

The tone of company meetings, however, did not match the subdued level of investor interest. After nearly three years of moderating growth, many REIT management teams see sunnier skies on the horizon, as supply pressures continue to moderate through 2025. As we approach 2026, the forecast for many property types appears markedly rosier.

Even Office REITs, the most visible victims of the new post-pandemic economy, espoused a positive outlook that was conspicuous and surprising to many seasoned veterans at this recent conference.

So how do we make sense of a seemingly improving outlook for REITs, with an obvious lack of interest from investors?

Behavioral finance would suggest that investor behavior is rarely optimal, and that human beings are simply not wired correctly to make rational, let alone optimal decisions consistently in the stock market. For this reason, the lack of interest in REITs makes some sense. Simply put, there have not been a lot of positive headlines around commercial real estate over the past few years, and therefore, interest in REITs has simply fallen off.

But looking forwards, there are three key dynamics that we believe could change the narrative.

Supply Pressures Fading. I may sound like a broken record here, but the competitive supply environment continues to improve for key players in the REIT industry. Multi-family (Apartments), and Warehouse REITs in particular (which make up close to +20% of the REIT universe) are poised to see accelerating fundamentals in 2026 as competitive supply pressures fade rapidly. A new bull market in Apartment REITs could attract significant incremental interest in REITs over the next 1-3 years.

Federal Reserve Easing. With inflation remaining top of mind for many investors, it is easy to forget that the Federal Reserve has flipped from hiking interest rates, to cutting interest rates. This is a significant change relative to 2022 and 2023, and continued interest rate cuts would be extremely beneficial to the entire REIT universe. As the saying goes “don’t fight the Fed”, and with an easing bias, the Fed is firmly on REITs side in 2025.

External Growth Accelerating: After falling for 10 straight quarters from Q4 2021 to Q2 2024, net acquisitions in the REIT market have now accelerated for three quarters straight. That means external growth has picked up, as REITs use their cost of capital advantage to grow their portfolios.

The Bottom Line: Internal (organic) growth is set to accelerate for many REITs as we head towards 2026. Simultaneously, REIT costs of capital are falling along with interest rates, and external growth via acquisitions is accelerating. These three pillars of REIT fundamentals are all moving in a positive direction, which was not the case in 2022, 2023, or 2024. Investors, however, remain skeptical, as evidenced by VNQ outflows and lack-luster REIT conference attendance. In our view, the likely resolution of this scenario is improved investor sentiment going forward, as REIT trends continue to improve.

STUDIO FULL OF TRACKS: Re-iterating REIT opportunities

One of the key reasons Serenity remains bullish on the REIT market is that at the individual REIT level, we continue to find compelling opportunities. What that means specifically, is that there are a plethora of REITs that are deploying investor capital in ways that any rational investor would replicate if given the chance. Here are a few examples.

Iron Mountain (IRM): Over the past 5 years Iron Mountain has reformed itself from a sleepy paper storage company into one of the leading providers of digitization services that are vital to the modern economy. This has caused IRM’s cash flow growth to accelerate, with no signs of slowing down. As demand for IRM’s data center business has grown, they have seen yields on their invested dollar grow from 8-10%, to 10-13%, making these deals more and more attractive. As a real estate investor, deploying capital into a company achieving 11.5% un-levered yields is close to a no-brainer. Serenity has a long position in IRM, and we are confident in the company’s ability to compound our fund’s capital over time.

American Healthcare Realty (AHR): As I have written ad-nauseum in these pages, the demographic tailwinds in the Seniors Housing industry are unlike anything I have seen in my 15-year REIT career. AHR is poised to benefit from the aging US population by harnessing a rare trifecta of growth tailwinds. Their portfolio should continue to grow organically (they did +21.6% same-store growth in 2024), externally (with over $300m in acquisitions in 2025), and via development ($100-200m in 2025 spend). At a modest valuation discount relative to peers, Serenity’s total return expectations for AHR remain firmly above +20% per year.

Essex Property Trust (ESS): With a premier portfolio of west-coast multi-family assets, Essex has historically been one of the best cash-flow compounders in the REIT universe. From 2011-2020, Essex averaged +6.7% same-store NOI growth and close to +10% annual growth in AFFO (cash flow per share). NOI growth for Essex accelerated in Q1 of 2025 to +3.3% from +1.7% in the previous quarter, showing early indications of a bottom and re-acceleration in west coast Apartment fundamentals. As supply pressures ease in coming years, and San Francisco continues to clean up its act, Essex is uniquely poised to benefit. A return to simply normal NOI growth (+4.2% over the past 20 years), could power Essex meaningfully higher, delivering strong total returns to investors (Serenity included).

The Bottom Line: The opportunity set in REITs is interesting from the top-down, but even more compelling from the bottom-up. There are a variety of REITs achieving low double digit returns on their investor capital, growing their NOI organically in the mid to high single digits, and even some REITs with a strong combination of both external and internal growth opportunities. From Serenity’s perspective, our capital will compound at attractive rates over time when invested with these companies, and there is a robust set of opportunities currently in the market.

WALL FULL OF PLAQUES: REIT volatility vs cash flow stability.

As public equities, REITs sometimes get a bad rap for their volatility. Real estate investors often do not like the fact that despite stable and growing cash-flows, REIT prices can still go down. This refrain has been common recently, as investors still remember the -25% REIT draw-down of 2022, and consistently see months in which REITs return +5%, -5% or even +10% or -10%.

It is important, however, to periodically step back and examine volatility at a higher level. A good question to ask is this…does the volatility of REIT cash-flows justify the volatility of REIT share prices?

The chart below displays REIT dividend payments going back to 2005. Dividends are a good proxy for REIT cash flows as they are legally required to be paid, and track REIT cash flows accurately over a longer time frame.

You will notice that apart from the great financial crisis, and the COVID pandemic, REIT dividends are extremely stable over time. They do not change much quarter to quarter, and since 2005, have a consistent track record of growth. Contrast this with REIT stock prices, which as we discussed earlier, can move up or down by up to +10% in any given month.

Now, which is more important for long-term investing success? A stable and growing cash flow, or a non-volatile stock price?

If you answered cash-flow growth, I would agree with you. In fact, if you have the ability to understand and analyze REIT cash flows, volatility can actually be a blessing, as you can “buy” these cash flows at attractive prices when volatility increases.

The Bottom Line: REIT volatility periodically scares investors into believing that REIT cash flows are much more volatile than they actually are. In reality, REITs have extremely stable cash-flows that have a strong track record of growth over time. For this reason, volatility can present opportunities to buy undervalued, highly durable cash flowing REIT portfolios.

NO BOATS, NO SNOWMOBILES, AND NO SKIS

REITs are not on top of investor radars in 2025 for a variety of reasons. The commercial real estate bear market that began in 2022 has been well documented, as rising interest rates and slowing growth have been a lethal combination for CRE of all stripes.

But in 2025, the adverse winds that have held REITs back are rapidly changing direction.

Fundamentals are beginning to improve, the Fed is cutting interest rates, and REIT management teams are getting aggressive on the offensive end. With very modest valuations, continued acceleration in growth could have an outsized impact on many REIT property types over the next 2 years.

The time to invest in REITs is not after the companies have gone up +45% as they did in 2021. The best time is when nobody is looking, when sentiment is subdued, and valuations are cheap. When everyone has left the REIT party. That time might just be right now.

Don’t let your dough freeze,

Martin D Kollmorgen, CFA

CEO and Chief Investment Officer

Serenity Alternative Investments

Office: (630) 730-5745

*All charts generated using data from Bloomberg LP, S&P Global, and Serenity Alternative Investments

DISCLAIMER: This document is being furnished by Serenity Alternative Investment Management, LLC (“Manager”), the investment manager of the private investment fund, Serenity Alternative Investments Fund I, LP (the “Fund”), solely for use in connection with consideration of an investment in the Fund by prospective investors. The statements herein are based on information available on the date hereof and are intended only as a summary. The Manager has been in operation since 2016 and the Fund commenced operations on January 14th. The information provided by the Manager is available only to those investors qualifying to invest in the Fund. By accepting this document and/or attachments, you agree that you or the entity that you represent meet all investor qualifications in the jurisdiction(s) where you are subject to the statutory regulations related to the investment in the type of fund described in this document. This document may not be reproduced or distributed to anyone other than the identified recipient’s professional advisers without the prior written consent of the Manager. The recipient, by accepting delivery of this document agrees to return it and all related documents to the Manager if the recipient does not subscribe for an interest in the Fund. All information contained herein is confidential. This document is subject to revision at any time and the Manager is not obligated to inform you of any changes made. No statement herein supersedes any statement to the contrary in the Fund’s confidential offering documents.

The information contained herein does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product. Any such offer or solicitation may only be made by means of delivery of an approved confidential offering memorandum and only in those jurisdictions where permitted by law. Prospective investors should inform themselves and take appropriate advice as to any applicable legal requirements and any applicable taxation and exchange control regulations in the countries and/or states of their citizenship, residence or domicile which might be relevant to the subscription, purchase, holding, exchange, redemption or disposal of any investments. The information contained herein does not take into account the particular investment objectives or financial circumstances of any specific person who may receive it. Before making an investment, prospective investors are advised to thoroughly and carefully review the offering memorandum with their financial, legal and tax advisers to determine whether an investment such as this is suitable for them.

There is no guarantee that the investment objectives of the Fund will be achieved. There is no secondary market for interests and none is expected to develop. You should not make an investment unless you have a long term holding objective and are prepared to lose all or a substantial portion of your investment. An investment in the Fund is speculative and involves a high degree of risk. Opportunities for withdrawal and transferability of interests are restricted. As a result, investors may not have access to capital except according to the terms of withdrawal specified within the confidential offering memorandum and other related documents. The fees and expenses that will be charged by the Fund and/or its Manager may be higher than the fees and expenses of other investment alternatives and may offset profits.

With respect to the present document and/or its attachments, the Manager makes no warranty or representation, whether express or implied, and assumes no legal liability for the accuracy, completeness or usefulness of any information disclosed. Certain information is based on data provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed and should not be relied upon as such. Performance information and/or results, unless otherwise indicated, are un-audited and their appearance in this document reflects the estimated returns net of all expenses and fees. Investment return and the principal value of an investment will fluctuate and may be quite volatile. In addition to exposure to adverse market conditions, investments may also be exposed to changes in regulations, change in providers of capital and other service providers.

The Manager does not accept any responsibility or liability whatsoever caused by any action taken in reliance upon this document and/or its attachments. The private investment fund described herein has not been registered under the Investment Company Act of 1940, as amended, and the interests therein have not been registered under the Securities Act of 1933, as amended (the “1933 Act”), or in any state or foreign securities laws. These interests will be offered and sold only to “Accredited Investors” as such term is defined under federal securities laws. The Manager assumes that by acceptance of this document and/or attachments that the recipient understands the risks involved – including the loss of some or all of any investment that the recipient or the entity that he/she represents. An investment in the Fund is not suitable for all investors.

This material is for informational purposes only. Any opinions expressed herein represent current opinions only and while the information contained herein is from sources believed reliable there is no representation that it is accurate or complete and it should not be relied upon as such. The Manager accepts no liability for loss arising from the use of this material. Federal and state securities laws, however, impose liabilities under certain circumstances on persons who act in good faith and nothing herein shall in any way constitute a waiver or limitation of any rights that a client may have under federal or state securities laws.

The performance representations contained herein are not representations that such performance will continue in the future or that any investment scenario or performance will even be similar to such description. Any investment described herein is an example only and is not a representation that the same or even similar investment scenarios will arise in the future or that investments made will be profitable. No representation is being made that any investment will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between prior performance results and actual Fund results.

References to the past performance of other private investment funds or the Manager are for informational purposes only. Other investments may not be selected to represent an appropriate benchmark. The Fund’s strategy is not designed to mimic these investments and an individual may not be able to invest directly in each of the indices or funds shown. The Fund’s holdings may vary significantly from these referenced investments. The historical performance data listed is for informational purposes only and should not be construed as an indicator of future performance of the Fund or any other fund managed by the Manager. The performance listed herein is unaudited, net of all fees. YTD returns for all indices are calculated using closing prices as of Jan 14th, the first day of the funds operation. Data is subject to revision.

Certain information contained in this material constitutes forward-looking statements, which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund described herein may differ materially from those reflected or contemplated in such forward-looking statements.

Our investment program involves substantial risk, including the loss of principal, and no assurance can be given that our investment objectives will be achieved. Among other things, certain investment techniques as described herein can, in certain circumstances, maximize the adverse impact to which the Fund’s investment portfolio may be subject. The Fund may use varying degrees of leverage and the use of leverage can lead to large losses as well as large gains. Investment guidelines and objectives may vary depending on market conditions.

Comments