REIT-HOUSE BLUES: JUNE 2021 NEWSLETTER

- Martin Kollmorgen

- Sep 7, 2022

- 13 min read

Updated: Sep 8, 2022

“Let it roll, baby, roll

Let it roll, baby, roll.”

– Roadhouse Blues – The Doors

• PERFORMANCE – Serenity Alternatives Fund I returned +1.45% in June net of fees and expenses versus the FTSE NAREIT REIT index at +2.77%. Year to date the fund has returned +25.7% versus the REIT index at +21.4%.

• NEXPOINT RESIDENTIAL TRUST (NXRT) – Why a sunbelt Apartment REIT with a knack for value creation continues to find its way into the Serenity portfolio.

• LET IT ROLL – Rents are moving rapidly higher for the Apartment REITs. Could this inflationary trend have broader implications?

By most accounts, the great lyrical poet Jim Morrison was not one to shy away from a good time. His lyrics are infused with Dionysian calls for revelry and enjoyment. We can imagine then that the self-proclaimed Lizard King was probably not one to leave a party early. As he says repeatedly in the classic tune referenced above…let it roll, baby, roll.

Investors, on the other hand, seem perfectly content to quietly bow out of this cyclical recovery just as it begins to gather steam. Calls for “transitory” inflation, doubts about demand, and a return to high-duration (read high multiple) stocks all continue to circulate in the investing ether. Memories of the slow growth 2016 – 2020 period permeate the mindset of portfolio managers of all stripes, prompting a return to “safety” on any piece of news that shows evidence of a slower pace of growth.

In our view, this willingness to leave the party comes much too early. The labor market is extremely tight and has only just begun to truly heal. The US consumer is flush with cash, the millennial spending wave is starting to gather steam, and many parts of the world are just beginning to re-open. Will we move past the extremely easy comps of 2020 over the next few months and see absolute growth rates decline? Yes, or course. But base effects are not the end-all-be-all of macro investing. If demand continues to show strength, growth rates will have to be revised higher, “transitory” inflation narratives will start to fade, and interest rates may increase meaningfully.

In this scenario, party-pooper investors will certainly regret an early cyclical exit. At Serenity, we will continue to roll with the data, which in this instance points to continued momentum. Apartment rents in particular show few signs of “growth slowing” at this point in the economic recovery. As things change, as always, we reserve the right to change our minds, but for now, we will continue to own pro-cyclical REITs that benefit from continued economic momentum. Let the cycle roll, baby, roll.

PERFORMANCE: +1.45% IN JUNE, +25.7% YTD

Serenity Alternatives Fund I returned +1.45% in June net of fees and expenses versus the FTSE NAREIT REIT index at +2.77%. The fund has now returned +25.7% for the year, versus the REIT benchmark at +21.4%. On a trailing 3-year basis Serenity Alternatives Fund I has returned +19.3% on an annualized basis net of fees and expenses. Over the same time period, the REIT benchmark has returned 12.0% on an annualized basis. The fund’s Sharpe ratio over the past 3 years sits at 1.17, versus 0.66 for the REIT benchmark.

REIT property sector performance in June illustrates the proclivity of investors to jump back into high-growth, high duration REITs that were stars from 2016-2020. Infrastructure and Data Centers, in particular, performed well during the month, despite few changes in fundamentals.

While both of these property sectors have steady high single-digit levels of growth, they come at a price well in excess of much of the rest of the REIT space. With cash flow multiples close to 30x, the question for investors becomes how much are they willing to pay for a high level of certainty in earnings growth? Is 2-3% excess growth per year worth a 10-15x higher multiple for these names?

Late in an economic cycle this may make sense, but in our view, the current accelerating growth in the economy should lift all boats. This includes much cheaper REITs in other property sectors that may begin to put up growth numbers not terribly different than their much more expensive Data Center and Infrastructure peers.

Again, how much is growth worth when it is widely available? This is a question investors have not had to ask since 2013-2015.

NXRT: A ROUGH-CUT SUNBELT DIAMOND

One of the best performing positions in the fund in June was Nexpoint Residential Trust (NXRT). NXRT is the 7th ranked name in our CORE quant model, owns a portfolio of apartment assets across the sunbelt (Dallas, South Florida, Phoenix, etc), and returned +6.72% during the month. NXRT possesses a combination of characteristics that our model and our fundamental outlook find favorable in the current economic environment. First of all, NXRT’s sunbelt exposure has allowed it to uniquely benefit from the de-urbanization that has occurred in part due to the pandemic. As millennials have moved out of urban centers in favor of faster growing, smaller, more affordable sunbelt markets, NXRT has benefitted with lower occupancy loss, and a faster recovery in rents than its urban Apartment REIT peers.

NXRT also has a size advantage to peers. At $1.4b in market cap, NXRT is significantly smaller than the peer average of $10b in the apartments sector. This is an advantage in a growing economy due to NXRT’s ability to grow its portfolio through acquisitions without having to do incredibly large deals. In the last cycle, NXRT demonstrated an impressive ability to buy lower quality multi-family assets and repurpose them, earning mid-teens returns on invested capital, and allowing them to grow earnings at a pace superior to their peer group.

Despite their potential for above peer growth on both an organic and external basis, NXRT still trades at a valuation discount to most other Apartment REITs. Relative to 2022 AFFO (cash flow), NXRT trades at a 21.0x multiple, versus a market cap weighted average of 26.8x for other Apartment REITs. From a cap rate perspective, NXRT trades at a 4.47% implied cap rate, versus many peers in the mid to high 3% range (lower cap rate = more expensive REIT.)

There are a few reasons for this valuation discount. The first is NXRT’s higher than peer leverage. At 50% Debt/EV, NXRT has higher leverage than its large cap Apartment REIT peers, which tend to run with between 20% and 35% Debt/EV. While we considered this a significant risk in early 2020, when the economy was slowing and risk of a recession was rising, we are in a very different economic situation today. With economic growth accelerating and a recession very closely in our rearview mirror, leverage is much less of a concern at this point in the cycle. In fact, it may be a benefit, as NXRT’s organic growth translates into more rapid earnings growth.

The other reason for the company’s valuation discount has to do with corporate governance. NXRT is an externally managed REIT, meaning the company pays an outside organization (Nexpoint Real Estate Advisors) to manage its assets and provide advisory work. Traditionally this is not an efficient arrangement as the drag on earnings and cash flow created by management fees tends to be higher for externally managed REITs. NXRT, however, does not have as onerous a management contract as many poorly run externally managed REITs, and during the previous cycle (2010-2019), NXRT had superior earnings growth and share price performance to peers IN SPITE OF their external management structure. Said another way, external management is a net negative, but it should not act as a significant drag on the company’s ability to create value over the next 3-5 years.

In the end, NXRT has the potential for above-peer growth at a discounted multiple. The company is small enough to do meaningful value-add deals, is exposed to some of the fastest growing markets in the US, and has a track record of adding significant value through an expanding economic cycle. It should be no surprise that NXRT ranks highly in our model and will remain an over-weight in the portfolio until the data changes or other opportunities look more attractive.

RISING APARTMENT RENTS: NO SIGNS OF FLAGGING DEMAND…

Data dependence is an oft echoed refrain of these pages and our current outlook is no exception. While analyzing top-down macro-economic data can prove insightful, it becomes much more powerful when coupled with on the ground fundamental data.

Clearly, apartment rents plummeted throughout 2020 as these two major cities remained in lockdown, saw skyrocketing unemployment, and bore the brunt of the pandemic-induced recession that occurred last year. What may be more interesting, however, is the recent direction of rents in each of these charts. While still well below 2019 levels, apartment rents are unequivocally rising in the two hardest-hit markets in the country.

The velocity of increasing rates is not insignificant either. This is not a slow and steady climb back to normal, this is a “V-shaped” recovery. As vaccination levels have increased and restrictions have been eased, apartment landlords have seen demand return rapidly, allowing them to raise rents consistently and quickly.

But is this trend consistent across the country? Is demand growth waning in markets that did not suffer as much through the pandemic?

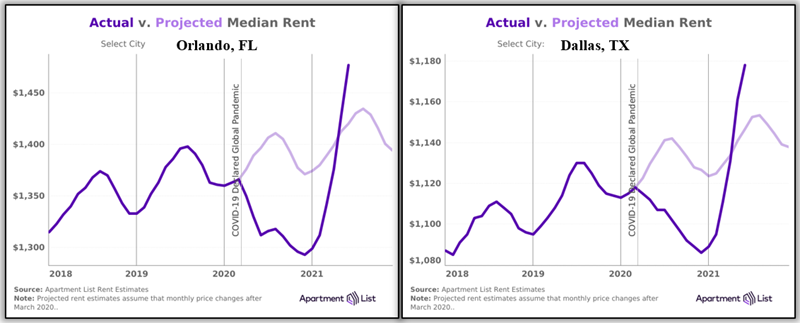

The two charts on the next page show rent levels in Orlando, FL and Dallas, TX. These two markets saw less rent degradation during the pandemic, re-opened sooner, and have already surpassed 2019 rent levels. And yet, rental rate growth shows no signs of abating. This would suggest that rent GROWTH is no longer a truly regional story, it is widespread and significant.

This is the type of bottoms-up fundamental data that it is important for investors to incorporate into their overarching view of the world. For those investors skeptical of the recovery or inclined to believe that inflation is transitory, these charts somehow need to be explained away. The “shelter” component of CPI (the literal government definition of inflation) is largely influenced by rent and house price growth. And these charts make clear that this component of inflation is moving higher and doing so rapidly.

So what does this mean for our portfolio? First of all it gives us confidence that the economic growth cycle is alive and well, as demand for apartments is clearly healthy across a wide range of major metros. It also gives us confidence in the fundamental outlook for the Apartment REITs in our portfolio (see NXRT, above).

Last of all rising inflation makes us slightly nervous regarding the current level of interest rates and their ability to remain low. If demand is this strong for high priced apartment units, it may be a sign of a broader demand surge that has yet to show up in the economic data. Such a growth “surprise” could easily send the 10y treasury yield towards 2% and beyond. The 10y is currently hovering around 2019 levels of 1.4%.

THE FUTURES UNCERTAIN, THE END IS ALWAYS NEAR…

Jim Morrison was a lyrical powerhouse. The future is uncertain, and the end of something is always near. In this instance, however, that something is not the economic cycle. While this recovery has been much more rapid than that of 2008-2009, there remain few (zero) economic expansions that have ended after six months of growth.

The burden of proof remains on those betting on the narrative of “transient” inflation. In order for that worldview to be correct, there has to be evidence of flagging demand or rapidly expanding supply in the economy that would keep prices in check. In the world of Apartment REITs, evidence of either of these sits somewhere between non-existent and very little.

For this reason, we continue to stick with cyclical REITs, remain wary of duration, and continue to tilt our portfolio towards those companies that can rapidly grow the value of their portfolios along with the broader economy. Value, momentum, and quality remain the cornerstones of our process, which so far in 2021 has delivered market-beating results. As the data change, we will change with it, but in the meantime, we will let it roll. Roll, baby roll.

Feel the Mojo Rising,

Martin D Kollmorgen, CFA CEO and Chief Investment Officer Serenity Alternative Investments Office: (630) 730-5745 MdKollmorgen@SerenityAlts.com

**All charts generated using data from Bloomberg LP, S&P Global, and Serenity Alternative Investments

DISCLAIMER: This document is being furnished by Serenity Alternative Investment Management, LLC (“Manager”), the investment manager of the private investment fund, Serenity Alternative Investments Fund I, LP (the “Fund”), solely for use in connection with consideration of an investment in the Fund by prospective investors. The statements herein are based on information available on the date hereof and are intended only as a summary. The Manager has been in operation since 2016 and the Fund commenced operations on January 14th. The information provided by the Manager is available only to those investors qualifying to invest in the Fund. By accepting this document and/or attachments, you agree that you or the entity that you represent meet all investor qualifications in the jurisdiction(s) where you are subject to the statutory regulations related to the investment in the type of fund described in this document. This document may not be reproduced or distributed to anyone other than the identified recipient’s professional advisers without the prior written consent of the Manager. The recipient, by accepting delivery of this document agrees to return it and all related documents to the Manager if the recipient does not subscribe for an interest in the Fund. All information contained herein is confidential. This document is subject to revision at any time and the Manager is not obligated to inform you of any changes made. No statement herein supersedes any statement to the contrary in the Fund’s confidential offering documents.

The information contained herein does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product. Any such offer or solicitation may only be made by means of delivery of an approved confidential offering memorandum and only in those jurisdictions where permitted by law. Prospective investors should inform themselves and take appropriate advice as to any applicable legal requirements and any applicable taxation and exchange control regulations in the countries and/or states of their citizenship, residence or domicile which might be relevant to the subscription, purchase, holding, exchange, redemption or disposal of any investments. The information contained herein does not take into account the particular investment objectives or financial circumstances of any specific person who may receive it. Before making an investment, prospective investors are advised to thoroughly and carefully review the offering memorandum with their financial, legal and tax advisers to determine whether an investment such as this is suitable for them.

There is no guarantee that the investment objectives of the Fund will be achieved. There is no secondary market for interests and none is expected to develop. You should not make an investment unless you have a long term holding objective and are prepared to lose all or a substantial portion of your investment. An investment in the Fund is speculative and involves a high degree of risk. Opportunities for withdrawal and transferability of interests are restricted. As a result, investors may not have access to capital except according to the terms of withdrawal specified within the confidential offering memorandum and other related documents. The fees and expenses that will be charged by the Fund and/or its Manager may be higher than the fees and expenses of other investment alternatives and may offset profits.

With respect to the present document and/or its attachments, the Manager makes no warranty or representation, whether express or implied, and assumes no legal liability for the accuracy, completeness or usefulness of any information disclosed. Certain information is based on data provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed and should not be relied upon as such. Performance information and/or results, unless otherwise indicated, are un-audited and their appearance in this document reflects the estimated returns net of all expenses and fees. Investment return and the principal value of an investment will fluctuate and may be quite volatile. In addition to exposure to adverse market conditions, investments may also be exposed to changes in regulations, change in providers of capital and other service providers.

The Manager does not accept any responsibility or liability whatsoever caused by any action taken in reliance upon this document and/or its attachments. The private investment fund described herein has not been registered under the Investment Company Act of 1940, as amended, and the interests therein have not been registered under the Securities Act of 1933, as amended (the “1933 Act”), or in any state or foreign securities laws. These interests will be offered and sold only to “Accredited Investors” as such term is defined under federal securities laws. The Manager assumes that by acceptance of this document and/or attachments that the recipient understands the risks involved – including the loss of some or all of any investment that the recipient or the entity that he/she represents. An investment in the Fund is not suitable for all investors.

This material is for informational purposes only. Any opinions expressed herein represent current opinions only and while the information contained herein is from sources believed reliable there is no representation that it is accurate or complete and it should not be relied upon as such. The Manager accepts no liability for loss arising from the use of this material. Federal and state securities laws, however, impose liabilities under certain circumstances on persons who act in good faith and nothing herein shall in any way constitute a waiver or limitation of any rights that a client may have under federal or state securities laws.

The performance representations contained herein are not representations that such performance will continue in the future or that any investment scenario or performance will even be similar to such description. Any investment described herein is an example only and is not a representation that the same or even similar investment scenarios will arise in the future or that investments made will be profitable. No representation is being made that any investment will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between prior performance results and actual Fund results.

References to the past performance of other private investment funds or the Manager are for informational purposes only. Other investments may not be selected to represent an appropriate benchmark. The Fund’s strategy is not designed to mimic these investments and an individual may not be able to invest directly in each of the indices or funds shown. The Fund’s holdings may vary significantly from these referenced investments. The historical performance data listed is for informational purposes only and should not be construed as an indicator of future performance of the Fund or any other fund managed by the Manager. The performance listed herein is unaudited, net of all fees. YTD returns for all indices are calculated using closing prices as of Jan 14th, the first day of the funds operation. Data is subject to revision.

Certain information contained in this material constitutes forward-looking statements, which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund described herein may differ materially from those reflected or contemplated in such forward-looking statements.

Our investment program involves substantial risk, including the loss of principal, and no assurance can be given that our investment objectives will be achieved. Among other things, certain investment techniques as described herein can, in certain circumstances, maximize the adverse impact to which the Fund’s investment portfolio may be subject. The Fund may use varying degrees of leverage and the use of leverage can lead to large losses as well as large gains. Investment guidelines and objectives may vary depending on market conditions.

Comments